This is The Takeaway from today’s Morning Brief, which you can receive in your inbox every Monday to Friday by 6:30 a.m. ET along with.

Wall Street appears to be sleeping through Washington’s latest debt ceiling crisis. It should wake up.

As Yahoo Finance’s Josh Schafer reported Tuesday, more than 70% of respondents in Bank of America’s latest fund manager survey said they expect a resolution before the so-called X-date — and an unthinkable first-ever default on government obligations.

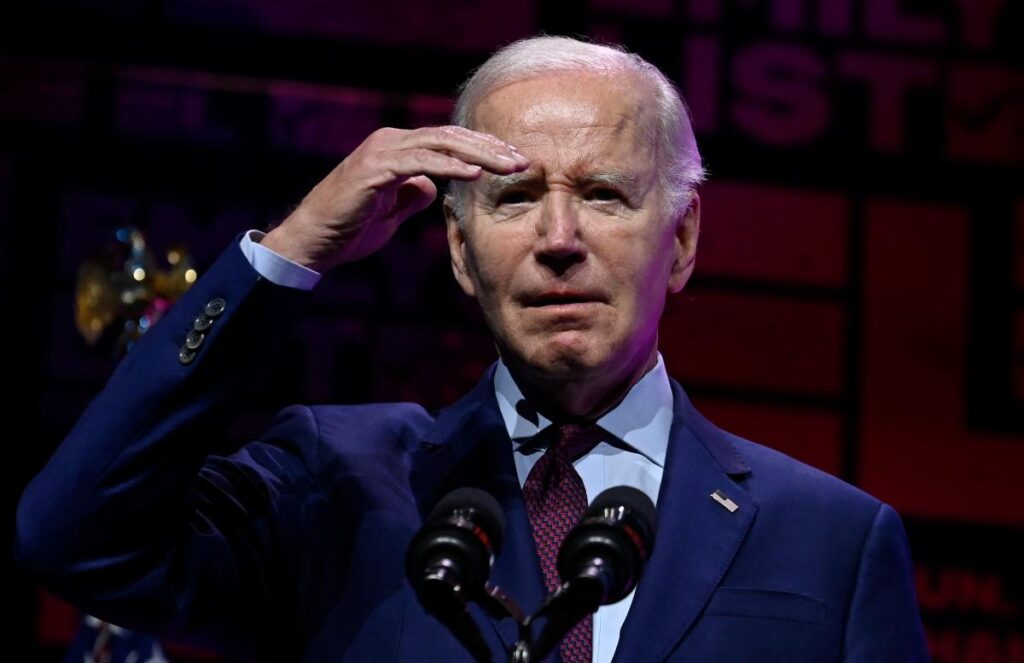

That’s despite a gloomy mood from both President Joe Biden and House Speaker Kevin McCarthy — although the latest round of talks Tuesday appeared to yield a bit of progress.

It’s also in the face of increasingly dire warnings from Treasury Secretary Janet Yellen, who seems to be issuing a letter every other week noting that she’s super serious, that X-date really could be June 1.

That is two weeks from now.

It’s not hard to see why Wall Street is yawning again. This “crisis” is entirely Washington’s own making, it comes from a silly system in the first place, and it happens every other year or so until they eventually figure things out.

But as a veteran observer and chronicler of many of these fights, this one worries me more than any since at least 2013 — if not 2011, which ended with a credit rating downgrade for the US. The problem is that McCarthy has no good way to get his increasingly irrational conference to agree to a deal. And Biden, for good reason, wants to nip this recurring threat in the bud — forever.

There is a way Biden can do that — though, like anything, it requires a bit of risk: One unilateral option that has gained traction the past few weeks — from no less than Biden himself — is the 14th amendment to the US Constitution.

The gist is that this Civil War-era amendment, which was put in place as a way to prevent Confederate states from defaulting on their debts, renders a concept like the debt ceiling null and void.

Of course, the risk is the unknown — it’s never been tried before, and it would likely face a legal challenge that could go all the way to the Supreme Court.

But might it be the best option for everyone? Bloomberg polled potential public reaction to Biden using another unilateral workaround — the minting of a trillion-dollar coin — and found that half the country still needs persuading either way.

A successful unilateral move is where Biden would be able to come in and say he stepped in to protect the full faith and credit of the United States (and everyone’s retirement accounts). The country would win, avoiding a potential default and having that nuclear option neutered forever. Even Republicans would win, as they could get to excoriate the president and not face flack from their voters for caving on their raucous demands.

Liam Donovan, a GOP strategist, has been on this idea that everyone wins for a while. Since Republicans have passed a bill as a starting point, the threat to go it alone is perhaps Biden’s biggest leverage.

The wild card, of course, is what happens after the fact. This is why Donovan still thinks any unilateral action is unlikely: The White House has probably determined the uncertainty around the eventual outcome would spook markets.

Just think about how each inkling projecting how the Supreme Court might rule would cause day-by-day market gyrations.

So the question for Biden is whether it’s a more palatable option than likely having to deal with this for the rest of his term. And whether it’s more palatable than the other option that shouldn’t be dismissed: default, which is also sure to spook Wall Street.

As Greg Valliere, chief US strategist at AGF Investments, told Yahoo Finance: “Yes, the stock market may view that as a gimmick, and maybe a market selloff would last a few days (or a few hours). [But] I think the market would get over it quickly.”

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

[ad_2]

Source link