Teryca Brooks-Long was desperate. Despite working four different jobs, she had racked up nearly $250,000 in student debt and was only sinking further into the red. Unable to keep her head above water, she called on personal finance YouTuber Caleb Hammer for help.

Hammer hosts a show on the social media platform called Financial Audit, where he sits down one-on-one with people to help them sort out their debt. His channel boasts 433,000 subscribers. He first shared Brooks-Long’s story in June of 2022.

She provided the “scary” details of credit card debt, car loan and other financial penalties. But it was her series of private student loans that really delivered the financial suckerpunch.

Don’t miss

Reflecting back on Brooks-Long’s story during a recent interview with Insider, Hammer said it “terrified and continues to terrify me.”

Here’s a look at the story and the advice Hammer shared with Brooks-Long to help her get out of debt.

Student debt — and how to pay it off

Like the majority of American students, Brooks-Long had to borrow money to pay for her degree, which she acquired from Baylor University.

But with no access to federal student loans due to a family issue around a contested inheritance, Brooks-Long had to turn to private funding from Sallie Mae.

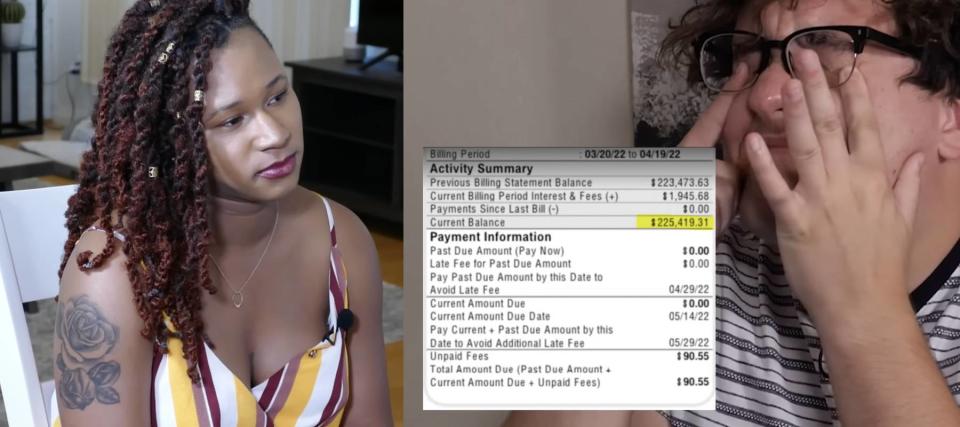

She took out three student loans worth about $176,000, but her debt swelled to nearly $250,000 with interest and fees.

Her bill between May and April of 2022 was $1,945 — more than two-thirds of her income of $2,816 working four jobs at the time she spoke with Hammer.

“It’s going to be a million dollars before she knows it,” Hammer told Insider, reflecting on Brooks-Long’s terrifying tale of student debt.

Brooks-Long is not alone in struggling with student debt. Today, Americans owe a combined $1.7 trillion for their education.

There are a few things you can do to reduce your student debt or pay it off faster.

If you have private loans, like Brooks-Long, you can attempt to refinance them to try and secure lower interest rates. Remember that it’s worth shopping around and comparing quotes from multiple lenders before selecting the option that best fits your needs.

Whether you qualify for refinancing will largely depend on your credit score and your current income.

If you have a federal loan, you won’t be able to refinance, but you could switch over to an income-driven repayment plan, which would allow you to make more affordable payments based on what you earn.

Read more: Here’s how much money the average middle-class American household makes — how do you stack up?

Avoid mistakes that will ruin your credit score

When Brooks-Long sought Hammer’s advice, the interest rate on her three private student loans was 11.75% on the two larger ones and 9.875% on the smaller one of $37,000.

In comparison, the interest rate for all new [federal direct undergraduate student loans for the 2022-23 school year is 4.99%.

Brooks-Long didn’t share how her student loans are structured, but Hammer told Insider he hoped she didn’t have a variable interest rate on her loans because the amount she owed would have increased due to repeated rate hikes.

In addition to her student loan struggles, Brooks-Long — who is trying to make it as an actress in San Antonio — told Hammer how she fell into credit card and car loan debt.

She took out a $13,500 auto loan, which costs her $300 a month, over a year ago, and she’s had to pay multiple late fees already.

When asked about her credit score, she found it had taken a big hit — from 720 to 549 — since acquiring the auto loan.

Hammer recommended she sell her car.

“You literally cannot afford this car,” he told her. “You cannot sell your credit card and pay it off. You cannot sell your student loans and pay it off. You can sell your car.”

But she insisted it wasn’t as big a problem as her student debt.

Brooks-Long also carried a balance on her credit card — something you should try to avoid because you can end up paying interest on your interest, and your balance can quickly spiral out of control — and admitted to overdrafting on her checking account multiple times a month.

“That is just dire,” Hammer told Insider. “That’s where it gets to the point where it feels like it’s impossible to get out of.”

All of these common financial mistakes can damage your credit score and leave you in poor standing if you need to borrow more money.

Boost your income

Brooks-Long took on multiple jobs to pay off her debts, including working as a virtual assistant for a realtor, an enrollment advisor for an online university, at an ad agency and modeling and acting gigs.

But ultimately, she was spending almost double what she was bringing in. Hammer said she needed to earn double or even triple her income in order to pay off her “ballooning” debts.

“If you don’t, you’re not going to be able to do anything for the rest of your life,” he told her.

There are multiple ways you can supplement your income. For instance, you could look for a new job that offers a higher salary.

If you don’t want to change jobs but do want to boost your income by working beyond the average 40-hour week, consider taking on multiple gigs like Brooks-Long.

You could also earn some extra income by selling items online, renting out some space (a room or even a parking spot) or getting a housemate who can split some of your housing costs.

Brooks-Long actually did this — splitting her bills with her roommate, who is her cousin — but she often ended up paying more than her fair share because her cousin was unemployed.

Hammer went on to advise she stick with a strict budget, which included no more eating out even if she needed to travel for work.

“Pack a sandwich,” he said.

All of the options listed above could open up more cash to help you pay off your debts on time and stop incurring those pesky interest fees and penalties.

What to read next

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

[ad_2]

Source link